quitclaim deed colorado taxes

Search Results for quitclaim deeds in the Colorado Legal Forms Library Skip to Main Content Search 35 forms found co-02-77 co-021-77 co-022-77 co-023-77. If the giver was gifted the home via a quitclaim deed and then executed a quitclaim deed to another person the person gifted the property would be on the hook for capital gains tax if he chose to sell the.

Ad Answer Simple Questions To Make Your Quit Claim Deed.

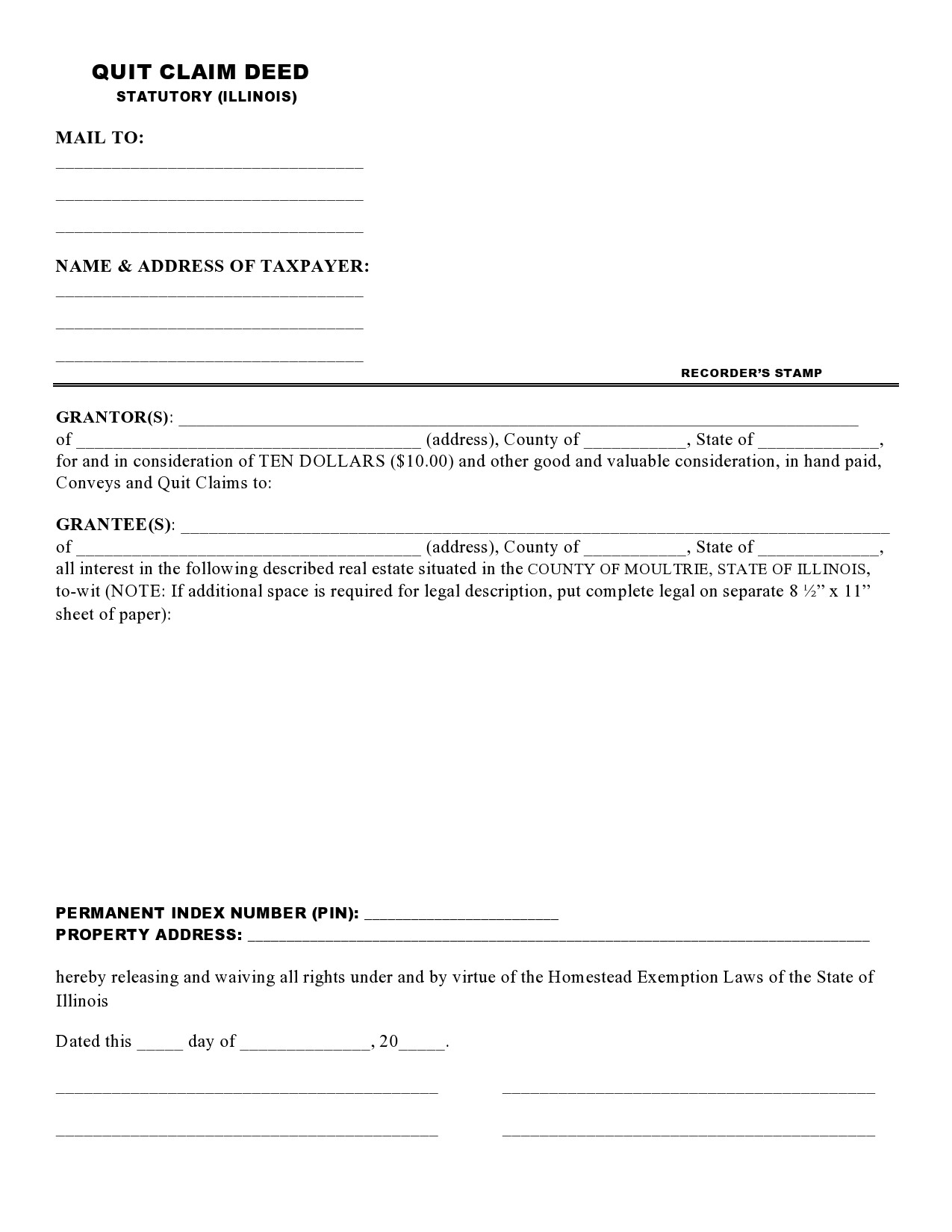

. Create Legal Documents Using Our Clear Step-By-Step Process. Get the quit claim deed colorado taxes and complete it with the full-featured PDF editor. Once blank is completed click Done.

PDF editor permits you to make modifications to the CO Quitclaim Deed Fill Online from any internet connected gadget personalize it according to your requirements sign it electronically and distribute in several. Real property was once transferred through a ceremonial act known as livery of seisin in which the person transferring the. Transfer Property Interest from One Person to Another.

Related

A Colorado quitclaim deed transfers property from the current owner the Grantor to a new owner the Grantee. 18 The filing fee includes a 300 surcharge earmarked for Colorados electronic recording filing fund. The grantee is named on the quit claim deed.

A beneficiary deed is a conveyance of an interest in real property which is revocable and which becomes effective upon the death of the grantor or. Of the Colorado Revised Statutes authorize the execution and recording of beneficiary deeds in Colorado. Ad Quitclaim Deed More Fillable Forms Register and Subscribe Now.

The documentary fee is assessed at 001 for each 10000 paid for the property payable to. If the transferor of a quitclaim deed in a home sale lived in the home as a primary residence at least two years of the past five capital gains of up to 250000 500000 if the quitclaim is conveyed by a couple filing jointly are excludable from tax. Create in 5-10 Minutes.

Distribute the prepared document via email or fax print it out or download on your gadget. Beneficiary deed forms are set forth in CRS. If the giver inherited the home and then executed the quitclaim deed to another person the person gifted the property could sell without paying capital gains tax.

Section 15-15-401 et seq. The only parties required to sign the quit claim deed are the grantor and the notary public. The person requesting recording of a Colorado deed must pay a filing fee of 1300 for the first page and 500 for each additional page.

Ad Legally Binding Quit Claim Deeds Forms. And QUITCLAIMED and by these presents does remise release sell and QUITCLAIM unto the Grantee and the Grantees heirs and assigns forever as _____ all of the right title interest claim and demand that the Grantor has in and to the real property together with the fixtures and. Deeds transferring Colorado real estate with a purchase price over 50000 are subject to an additional documentary fee similar to transfer taxes in other states.

If the giver inherited the home and then executed the quitclaim deed to another person the person gifted the property could sell without paying capital gains tax. A quit claim deed can be obtained from an attorney a real estate agent from one of the many businesses that sell legal documents or even downloaded online. As to the tax question the IRS will view the addition of the letter writer via quitclaim deed as a gift.

Be sure to specify that the deed is for Colorado. To avoid probate many people will quit claim the property from themselves to themselves and a child in joint tenancy. For example A executes a Colorado quitclaim deed from A as grantor to A and child of A as grantees in joint tenancy with right of.

Tax Forms Attorney Directory External Links Law Digest Legal Q A LegalLifee Articles Helpful Topics quitclaim deeds. Top 5 Facts About Quitclaim Deeds. A deed executed according to the form in section 38-30-113 with the word quitclaim substituted for convey and the words and warrant the title to the same omitted therefrom shall be a deed of quitclaim and shall have the same effect as a conveyance as quitclaim deeds now in use.

The excluded amount is taken off the taxpayers total allowable lifetime exclusion.

How To Create A Quit Claim Deed Youtube

How To Fill Out A Quitclaim Deed 12 Steps With Pictures

41 Free Quit Claim Deed Forms Templates ᐅ Templatelab

Pin By Sergej Stankov On Ma Aurelia Benitez Garcia Beautiful Landscape Wallpaper Landscape Photography Nature Beautiful Nature Scenes

How To Fill Out A Quitclaim Deed 12 Steps With Pictures

A Notary Certificate In 4 Simple Parts Notary Notary Public Business Notary Signing Agent

Quit Claim Form Everything You Need To Know About Quit Claim Form Quitclaim Deed Power Of Attorney Form Quites

41 Free Quit Claim Deed Forms Templates ᐅ Templatelab

Colorado Quit Claim Deed Form 100 Free Cocosign

Pin By Sergej Stankov On Ma Aurelia Benitez Garcia Beautiful Landscape Wallpaper Landscape Photography Nature Beautiful Nature Scenes

How Much Is 3 Quarters Of A Million Dollars Scramble Words Dollar Health Technology

Colorado Quitclaim Deed Form Download Printable Pdf Templateroller

Colorado Quitclaim Deed For Joint Ownership Legal Forms And Business Templates Megadox Com

5 Income Tax Tips For Notaries And Signing Agents Tax Deductions Irs Taxes Tax Questions

Pin On Miami Real Estate Deals 2020

Colorado Quitclaim Deed Legal Forms And Business Templates Megadox Com

What Is A Quitclaim Deed And When Do You Need To Get One